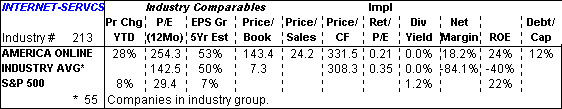

The table

at the bottom of the Snapshot report provides an overview of how a company

measures up against its industry peers and the overall market on a number

of key measures. Data includes year-to-date price change, P/E (12 month),

estimated 3-5 year EPS growth rate, Price/Book, Price/Sales, Price/Cash

Flow, implied return to P/E ratio, dividend yield, Net Margin, ROE,

and Debt/Capital. The industry

comparable data is most useful for relatively homogeneous industries.

Zacks large number of industry classifications (over 200) helps to insure

comparability between companies.

Back | Snapshot | Research Cascade Help Home Page